Welcome to Pay Academy

We manage payroll, pensions and payment solutions for small and actually quite large UK employers

call us on

01332 747017

When we get ‘higher-than-normal call volumes’ we answer the phones because a quick conversation is worth a thousand emails

Our Services

Payroll

We are a team of payroll experts based in our Derby office, offering a bespoke service for employers ranging from 1 employee upwards We have a BACS/faster payment solution which allows us to settle payments directly from your account to your employees’.

We charge per payslip so our fees are volume driven and as quoted – no ticking clock, no timesheets.

Pension

We manage over a dozen different pension portals on behalf of many of our payroll clients. We also register with The Pensions Regulator as your agent in order to update and manage your TPR compliance including re-enrolment, returns to the Regulator and all statutory communications.

So if you don’t want the headache of pension administration why not entrust it to the same people you trust with your payroll?

Our Clients

Splice

They have ably supported us through significant growth, internal restructure and AE; always with a “can do” attitude – Kate Higham, HR and Finance, Splice Post

Angst Productions

Pay Academy has saved me many times. They always know what needs to be done and have done it before I realise I need to do it! – Annie McGeoch, Finance manager specialising in TV production

Dewynters

Fast, efficient and accurate. That’s the service we want and the service we get – Simon Shimell, Finance Manager, Dewynters

David Nieper

We all need payroll to be 100% accurate and 100% reliable. Pay Academy have been faultless for ten years.

Our Team

Shirley Hall

Doctor of payroll and founding director in 2005. Shirley worked at Cooper Parry in varying roles over 18 years (including setting up the payroll bureau). She left to wander around in industry for a bit before coming home to payroll with Niki and Pay Academy

Niki Caister

Chartered accountant and founding director of the company in 2005, previously a partner at Cooper Parry in Corporate Finance and before that a senior auditor. Yawn….

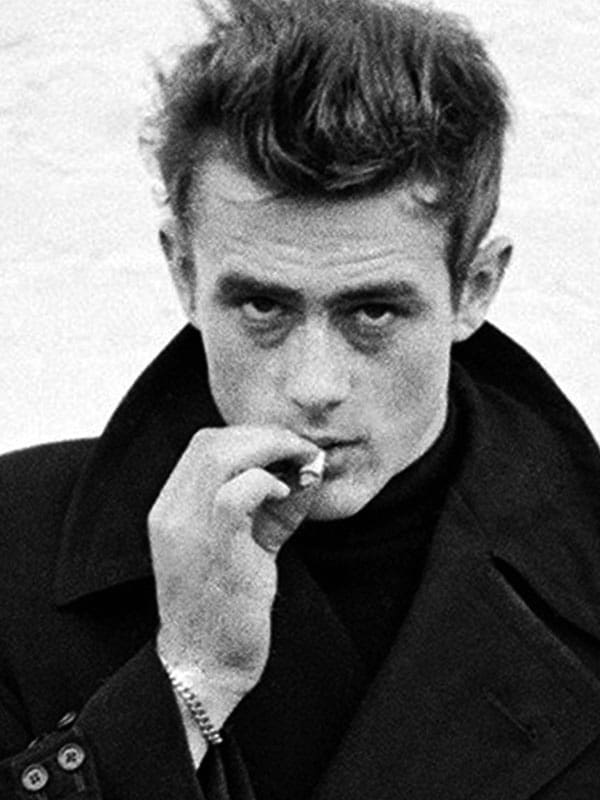

James Dean

Originally joined us in 2016 on a short term contract to help us get our clients auto-enrolment ready. He enjoyed it so much that he never left. Now a fully-fledged payroll administrator, he is still our go-to guy on pension work

Sharon Brown

Our invaluable office manager and general organiser of all things. Sharon has had a few previous lives including one as a registered nurse. Always handy when one of us is feeling peaky

Natasha Caister

Natasha joins us having graduated from the University of Leeds in French and Spanish. She is tackling employment tax while she decides what she wants to do with the rest of her life, which is how we all ended up here…

Latest News

-

Tax & Facts: All you need to know for 2025-2026

Welcome to the 2025-26 tax year! Please see below for all the key info you will need in respect of…

-

Tax & Facts: All you need to know for 2024-2025

So 2024-25 facts and figures can be found below. Significant change on national minimum wage, (see percentage changes over 20%)…

-

National Minimum Wage – the truth hurts

We have witnessed a number of investigations in this area recently and thought it might be a good idea to…

-

Tax & Facts 2023-2024: Rates and thresholds for the new tax year (provisional subject to change)

All the figures given below are subject to change in the budget announcement on the 15th March. Indciations so far…

-

Christmas Give Away: The not so trivial, trivial benefit

Trying not to bore you as we approach the business end of the year so here is a quick Christmas…

-

We need to talk about holiday pay

We have had a landmark ruling from the Supreme Court in relation to the calculation of holiday pay for part-year…